Escrow

Goldman Sachs Transaction Banking (TxB) serves as a neutral third-party agent independently holding funds. Our escrow team has deep industry knowledge and is focused on providing solutions that are straightforward to set up, simple to administer, and replicable across multiple transactions.

TxB Provides a Differentiated Service

Flexible pricing, including for closing costs, and competitive deposit rates

Template agreement is straightforward & customizable

Fast turnaround for KYC processing and account opening²

Easy-to-use Client Portal consolidates accounts in one place

TxB Escrow team has many years of industry experience and can adapt to unique deal requirements

² Subject to the receipt of all required KYC documentation

Escrow Services for Mergers & Acquisitions

Applications for escrow are present throughout the lifecycle of an M&A transaction and TxB is poised to help support these use cases with our straightforward approach to establishing escrow accounts.

Acquisition Financing

Hold financing proceeds that are earmarked

for their stated purpose.

Cash Confirmation

Demonstrate proof of funds to satisfy requirements set forth by the Takeover Panel.

Target Identified

Due Diligence

Financial Close

Fulfillment

Indemnity Holdback

Service claims for any inaccurate representations and warranties made in the sale process.

Working Capital /

Purchase Price Adjustment

Offset any adjustments in valuation of the target company, post-closing.

Insurance Exclusions

Hold exclusions not covered in insurance policies such as environmental risks or pending tax liabilities.

Retention / Earnout

Deferred payments to key employees with periodic releases for performance milestones met.

Companies active in M&A can improve deal execution by simplifying processes such as escrow account set-up. TxB works with clients to establish a replicable solution that can support their activity:

Portfolio Escrow Solutions

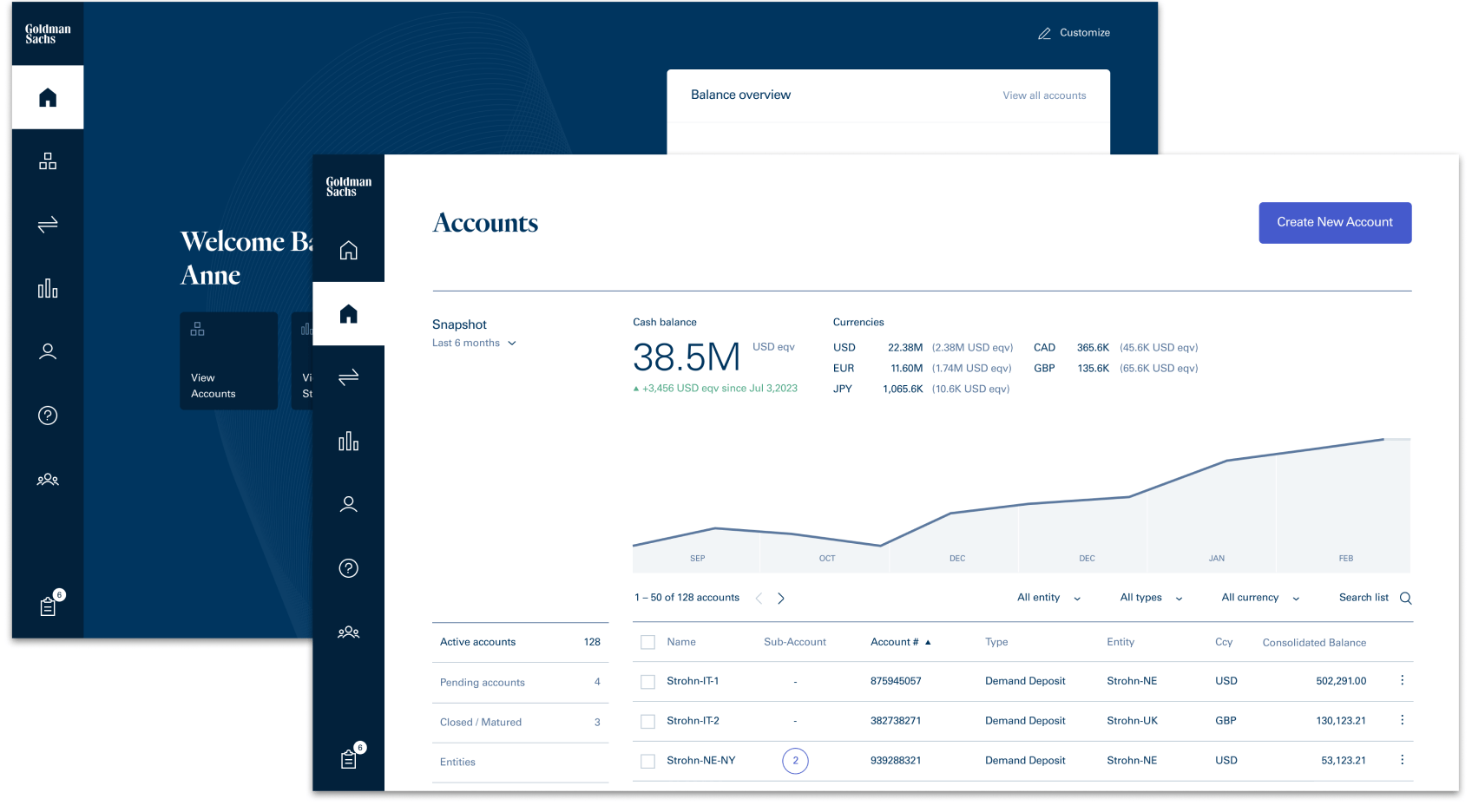

The TxB Client Portal is a cloud-native transaction banking platform built to provide an intuitive,

user-friendly experience. Manage your TxB accounts, including your escrow portfolio, in a consolidated, easy-to-use UI, with robust reporting capabilities.

Client Portal

Image is simulated and for illustrative purposes

TxB accounts can be used to segregate drawn proceeds for a transaction. Our control agreements maintain existing pledges to Secured Parties and provide a clear account control structure.

Controlled Agreements for Capital Markets

Pre-negotiate a template escrow agreement that can be used on future transactions

... simplifies deal-by-deal negotiation

Onboard client legal entity or entities in advance of transaction

... reduces closing complexity

Centralize account information and reporting for all accounts on the

TxB Client Portal

... consolidates tracking and reporting

Good Faith Deposits / Termination Fees

Prefund deposit to demonstrate serious interest or cover potential termination fees.

Acquisition Finance

Secured Lending

High Yield Debt Issuance

Term / Revolver Draws

Cash Collateralized LCs

Real Estate / Construction

Regulatory / Tax / Litigation

Bankruptcy / Restructuring

US only

US only

US only

¹US only

Certain products are not yet live offerings and are contingent on internal approvals by Compliance and other internal stakeholders.

¹US only

Certain products are not yet live offerings and are contingent on internal approvals by Compliance and other internal stakeholders.

¹US only

Certain products are not yet live offerings and are contingent on internal approvals by Compliance and other internal stakeholders.

¹